Living Protection For Things You Can’t See Coming

Stroke, Heart Attack, Sickness, Accident

Get Covered Now

Flexibility For Needs As Individual As You

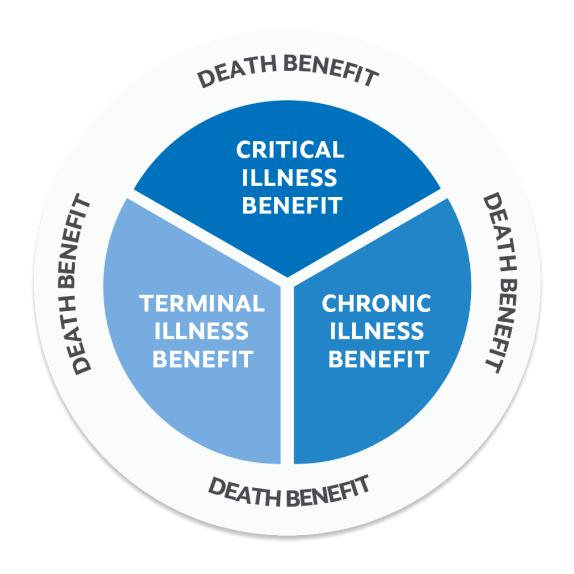

living benefit riders can provide early access to your policy’s death benefit, should the you experience a qualifying chronic, critical, or terminal illness such as a stroke, cancer, heart attack, or paralysis. Think about that! When you’re planning for the future, it’s good to know you’ll have protection for you and your family should the unexpected arise.

Get It Now!You should have access to benefits you can use, while you are living!

LIFE Insurance, not Death Insurance

RIDERS

- Accidental Death Benefit Rider

- Additional Insured Rider

- Base Insured Rider

- Children’s Benefit Rider

- Disability Waiver of Monthly

- Deductions Rider

- Disability Waiver of Premium Rider

- Guaranteed Insurability Benefit Rider

- Long Term Care Rider

- Overloan Protection Rider

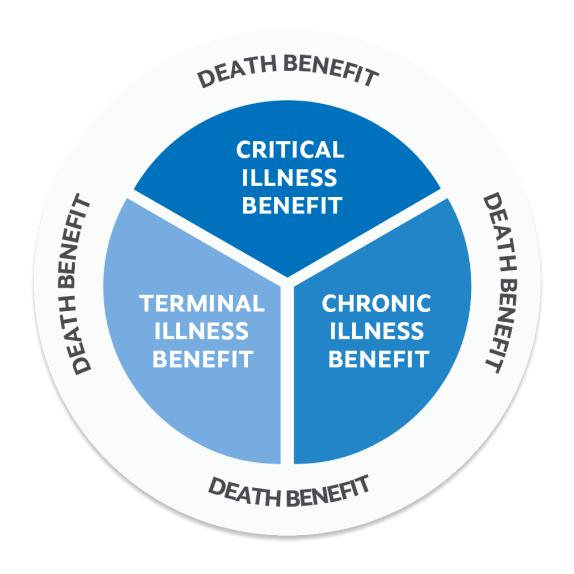

LIVING BENEFIT RIDERS:

- Chronic Illness Accelerated Death

- Benefit Rider

- Critical Illness Accelerated Death

- Benefit Rider

- Terminal Illness Accelerated Death

- Benefit Rider

FREQUENTLY ASKED QUESTIONS

WHY IS LIFE INSURANCE WITH LIVING BENEFITS SO IMPORTANT?

Most life insurance policies only protect your family after you pass away. The plan with living benefit riders does that, plus provides you valuable access to accelerate your death benefit while you are alive, provided certain conditions are met. People see this as a smart way to have funds they may need without having to access a retirement account, 401(k), or liquidate CDs.

WHAT CAN I USE THE MONEY FOR?

It’s up to you. You can pay for care or treatment that may not be covered by your health insurance plan, replace income lost as a result of your illness, provide for in-home care or facility needs, bring the entire family together for a reunion, or use the money however you wish.

WHAT IS THE DIFFERENCE BETWEEN LIVING BENEFITS ON A LIFE INSURANCE POLICY AND ACCELERATED DEATH BENEFITS?

Living benefits and accelerated death benefits are terms used interchangeably on a life insurance policy. Both can provide access to funds should you suffer from chronic, critical, or terminal illness. When you choose to use your living benefits, you are accelerating your life insurance policy’s death benefit so that you can use the funds while you are alive. The death benefit will be reduced by an amount greater than the accelerated payment amount. The reduction in the policy’s death benefit will reduce the amounts payable to the beneficiary(ies) upon death.

“I have been working with this company for several years. I have always been very happy with them. Check them out!”

Barb W.

“When I needed to get life insurance for my mother, I ended up also getting it for myself too....was blown away with the accuracy, details, and knowledge I got from them.”

Derek B

“Have looked at life insurance for a while now and, since I am 68 years old, was frustrated but they got me what I need, great rate, great people.”

James R.

“No pressure, no calls all the time, and I found a plan I didn’t even no existed, was approved that day. My husband too. Easy to deal with and knowledgeable.”

Wendy D.

“I have an awesome Agent....Provides great, timely, responsive communicative service, available by phone, text or email.”

Elizabeth F.

REAL LIFE EXAMPLES OF HOW

LIVING BENEFITS ARE USED

MEET RYAN

PROFILE: Male, age 45, preferred plus, nonsmoker

INITIAL FACE AMOUNT: $500,000

MONTHLY PREMIUM: $472

EVENTS: Pancreatic cancer at age 53

ACCELERATED DEATH BENEFIT (ADB):

This example assumes that Adam elects to accelerate the

maximum allowable amount of 100% of the available

death benefit, which is $500,000.

HYPOTHETICAL CASH PAYMENT FROM ADB:

AGE 53: $462,144

FACE AMOUNT REMAINING AFTER ADB EXERCISED:

AGE 53: $0

TERMINAL ILLNESS

Having a terminal illness means you have been diagnosed by a physician with

a medical condition resulting in a life expectancy of 12 months or less.

DEVASTATING DIAGNOSIS

At 45, Adam earned $125,000 a year and thought it was time to get his

finances in order. He purchased a 20 Term life insurance policy with living

benefit riders with a face amount of $500,000, for only $472 per month.

Sadly, eight years later Adam was diagnosed with pancreatic cancer and was

told he had eight months to live. Though a heartbreaking diagnosis, Adam

took comfort knowing that he was entitled to accelerate 100% of his death

benefit immediately. Adam received $462,144 of the $500,000 face

amount after the discount factor and fees were deducted

MEET RYAN

PROFILE: Male, age 61, standard, nonsmoker

INITIAL FACE AMOUNT: $1,000,000

MONTHLY PREMIUM: $1,212

EVENTS: Serious illness at age 65

REDUCTION IN LIFE EXPECTANCY: 80%

ACCELERATED DEATH BENEFIT (ADB):

The maximum amount that can be accelerated with the critical illness

rider is the lesser of 90% of the available death benefit or $1.5 million.

This example assumes that Ryan elects to accelerate the maximum

allowable amount for his policy, which is $900,000.

HYPOTHETICAL CASH PAYMENT FROM ADB:

AGE 70: $927,014

FACE AMOUNT REMAINING AFTER ADB EXERCISED:

AGE 65: $100,000

Premiums will be reduced proportionately and will continue to be

payable on the reduced face amount remaining. The payments and

results of the examples shown may vary by state.

CRITICAL ILLNESS

Being critically ill means you’ve been diagnosed by a physician with a

health condition such as a heart attack, stroke, cancer, end stage renal

failure, major organ transplant, blindness, paralysis, AIDS, aplastic

anemia, first coronary angioplasty, first coronary artery bypass, motor

neuron disease, or central nervous disease. Critically ill means you’ve

been diagnosed after the rider date with a medical condition that would,

in the absence of treatment, result in your death within 12 months.

HELP FOR THE UNEXPECTED

As the father of two grown children and a successful executive, Ryan

wanted to make sure his grandchildren would be taken care of, regardless of

what may happen to him. He chose to purchase a 25 year Term life policy

with optional living benefit riders in the amount of $1 million. The

premium payments were under $1,212 per month and fit in his budget.

Five years later, Ryan suffered a serious illness and he had to undergo a

major organ transplant as a result. That had a severe impact on his life

expectancy. Ryan chose to accelerate a portion of his death benefit right

away, which helped pay for things like his ambulance transportation,

organ transplant, and hospital stay. He’s thankful he still has a portion of

his death benefit left over for his children, should he pass away too soon.

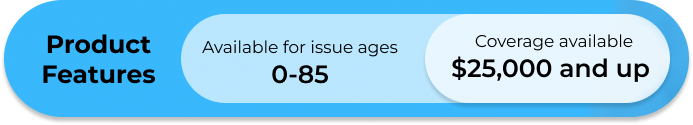

What We Offer!

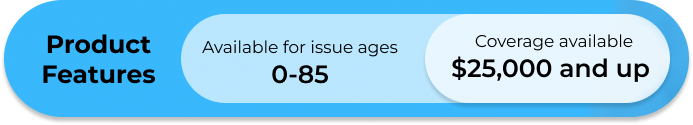

Whole Life Insurance

Final Expense

Final Expense Instant Approval

Instant Approval Cash Value

Cash Value From $5,000 to $2,000,000

From $5,000 to $2,000,000 Living Benefits

Living Benefits

Universal Life Insurance

Permanent coverage with flexible premiums. Option to guarantee death benefit. Ability to borrow against your policy. Instant Approval.

Term Life Insurance

We offer 10-, 15-, 20-, and 30-year terms in addition to permanent products. Whatever your needs, we have it covered.

Fast, online life insurance with no medical exam

Complete our 100% online application in minutes. Just answer a few health questions and receive your life insurance quote today with no requirements of a medical exam.

APPLY NOW