NO Medical for ALL Plans!

For most, medical exams can be a pain (especially with the needles!) but we try to offer our clients the options for a completely non-medical option for EVERY type of plan, listed below! Over 50 or 60? This is critical in securing the proper coverage.

Get Covered Today

Simplified issue vs. fully underwritten

EquoteLife offers term life insurance policies with both simplified issue and fully underwritten options. Understand the differences and what it means for you.

Learn moreSimplified issue:

Most of our term policies are simplified issue, meaning the application process and underwriting decision come instantly based solely on third-party data and the applicant's responses to health questions within the application. No medical exam is necessary.

Simplified issue underwriting may be right for you if:

- You need life insurance, but you aren’t sure you’d qualify for a traditionally underwritten policy

- You want a simple process without medical exams or lab tests

- You thought you couldn’t get life insurance because of your age or health

Fully underwritten:

We also offer fully underwritten term policies, a more traditional method that historically includes a complete application and medical exam. EquoteLife modernizes the process and doesn't require a medical exam but does include health questions within the application to help determine premium levels.

Fully underwritten policies may be right for you if:

- You’re in good health

- You’re looking for life insurance with a higher death benefit

- You don’t mind a longer application process

Whole Life & Final Expense

What is whole life insurance?

Whole life insurance can last the rest of your life with a guaranteed payout for your loved ones.

Whole life insurance may be a great fit for you if:

- You want coverage for the rest of your life

- You want a policy to build cash value over time

- You want to invest for a long-term benefit

Our whole life insurance for seniors

We’re striving to make getting whole life insurance simpler, faster, and just plain easier here. Equote offers whole life insurance with guaranteed approval in a matter of minutes for those ages 60 to 85, no matter your health history. With no medical exams, simply answer a few health questions to help determine the rate on your guaranteed coverage. Policies range from $1,000 to $50,000 and feature a secure rate that never increases, covering you for life.

I Need This

Indexed Universal Life

What Is Indexed Universal Life (IUL) Insurance?

Indexed Universal life (IUL) insurance is a type of permanent life insurance that, like other permanent insurance, has a cash value element and offers lifetime coverage as long as you pay your premiums. Unlike whole life insurance, universal life allows you to raise or lower your premiums within certain limits, and it can be cheaper than whole life coverage. Great for mid 40’s with family and even up to 75 years old!

As the name implies, the COI is the minimum amount of a premium payment required to keep the policy active. It consists of several items rolled together into one payment. COI includes the charges for mortality, policy administration, and other directly associated expenses to keep the life insurance policy in force. If you are generally healthy, this is the way to go!

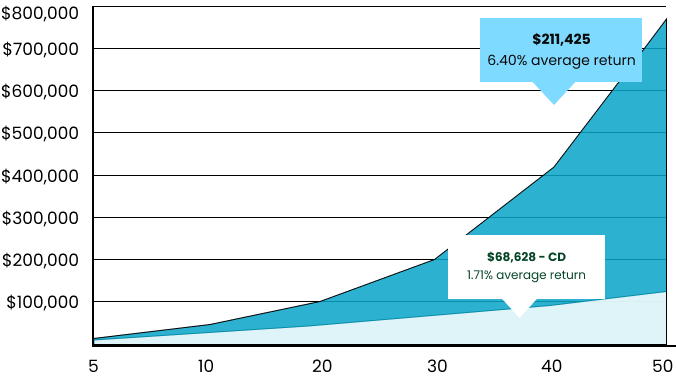

Rates for IULIUL CASH VALUE EXAMPLE

IUL policies typically allow you to grow a portion of your premiums through allocation to an index. Insurers often offer a growth cap of 8-9% and floor of 0%. This allows for upside potential with downside protection. Did I mention it’s all tax-efficient?

Get a Rate!

DEATH BENEFIT

A death benefit will be associated with the policy based on an individual's age and health.

- Example of an IUL policy that achieves a 6.4% annual return with tax deferral and reinvested dividends*

- Bank Savings CD account averages 1.71% annual return with taxable interest payments at 35%*

*Tables and charts are for illustrative purposes only and are not based on any specific policy example. Please reference your specific policy for additional details. All guarantees and contractual obligations are based solely on the claims-paying ability of the issuing life insurance company.

Term Life Insurance

What is it and how does it work?

Term life insurance features the most straightforward and affordable life insurance option by covering you for a set "term" (typically 10 to 30 years). If you pass away during the term period, your beneficiaries receive a cash payment.

Term life insurance with equote might be right for you if:

- Your loved ones would need to replace lost income while raising children or paying a mortgage (also called Mortgage Insurance)

- You have short-term financial responsibilities such as loans, a new business, or credit card debt

- You want the most affordable life insurance coverage

- You appreciate the straightforward nature of term life insurance

We have VERY unique plans, even TERM plans that don’t run out! What does this mean? It means, if your term policy runs out, you can keep it and still pay the same amount, but with a reduced benefit, so you don’t end up with no coverage!

See your Rates

Check Out These NO Medical Exam Rates!

55 Year Old Woman

$100,000

Permanent Life

$126.91/mo

Living Benefits Like Chronic Illness, Critical Illness, and more all at no extra cost!

55 Year Old Woman

$100,000

Permanent Life

$171.79/mo

Living Benefits Like Chronic Illness, Critical Illness, and more all at no extra cost!

55 Year Old Woman

$50,000

Permanent Life

$66.14/mo

Living Benefits Like Chronic Illness, Critical Illness, and more all at no extra cost!

Why purchase with

Fast process (no medical exams)

Our 100% online and hassle-free process makes it easy to apply. What traditionally took weeks can now be done in minutes, and you don't even need a medical exam (just answer a few health questions). There are some instances when underwriters need more information about your health to complete the application process.

Expert advice

You don't have to talk to an agent if you don't want to, but if you do, our licensed agents remain ready and eager to answer your questions. They're here to help you find the right life insurance policy for you.

Flexible coverage

Get anywhere from $20,000 to $2 million in term life insurance protection. Choose between 10-, 15-, 20-, and 30-year terms.

Free-look, money-back guarantee

Take your policy for a trial run with a 30-day money-back guarantee. If you're not fully satisfied in the first 30 days, we'll refund you in full. After that time, you can cancel your policy with no cancellation fees.